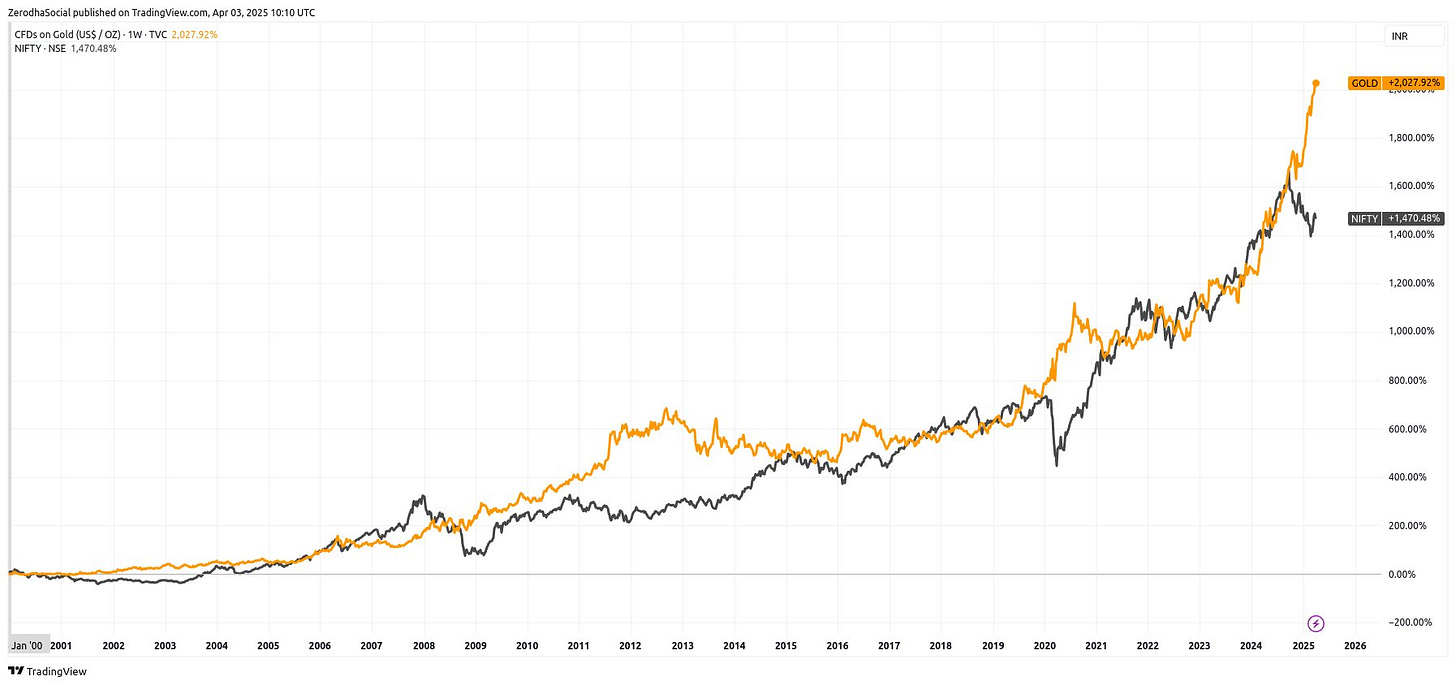

I'm cherry-picking the date, but it's kinda crazy that since 2000 gold seems to have generated higher returns than Nifty.

We couldn't have timed the launch of the GOLDCASE, ZerodhaAMC's Gold ETF any better😬First, gold prices started shooting up and then the stopping of sovereign gold bonds (SGBs). Now that SGB issuance has stopped, Gold ETFs are probably the best way to get exposure to gold.

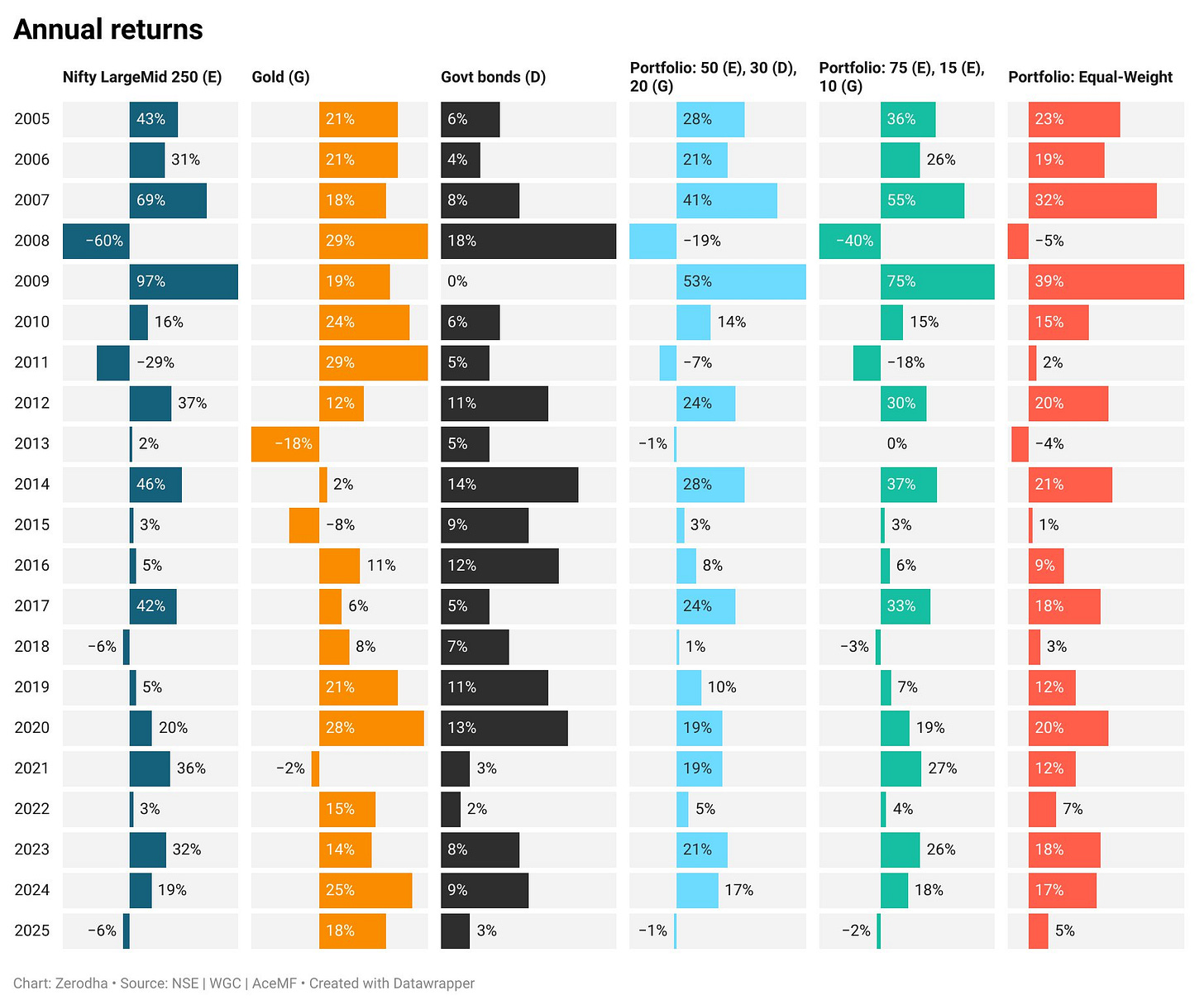

Gold has been kind to Indian investors and has provided some diversification benefit. Nobody can explain what makes gold prices move, but it seems to work.

If you do nothing and just sit on it, then even a bluechip like Nestle, Britania, Coke, TCS etc can beat gold. The problem is that folks tend to sell stocks when they see red vs folks in india never sell gold even if the price falls.

Hats off to your candidness, as always, when you say “Nobody can explain what makes gold prices move” and that the date has been cherry picked. Would a rolling returns analysis solve this date cherry picking issue? Also, the comparison doesn’t seem to be vs. Nifty TRI, is it?