You’ve got to hand it to SEBI for going after Jane Street. If the allegations are true, it’s blatant market manipulation.

The shocking part? They kept at it even after receiving warnings from the exchanges. Maybe this is what happens when you're used to the lenient U.S. regulatory regime. Think about the structure of U.S. markets: dark pools, payment for order flow, and other loopholes that allow hedge funds to make billions off retail investors. None of these practices would be allowed in India, thanks to our regulators.

That said, there’s a flip side. Prop trading firms like Jane Street account for nearly 50% of options trading volumes. If they pull back— which seems likely —retail activity (~35%) could take a hit too. So this could be bad news for both exchanges and brokers.

The next few days will be telling. F&O volumes might reveal just how reliant we are on these prop giants. I’ll share more data as and when anything interesting turns up.

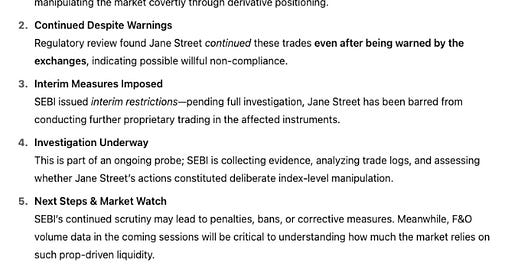

By the way, this is the summary from ChatGPT if you are unaware of the issue.

Nothing is going to come out of this. Another pseudo-investigation, things under the table, and then JS will start quietly again. Bet on that?!

Agree - props to SEBI for banning Jane Street. It’s one thing for it to make money off of the citizens of the country it operates in. Whole other to be so scheming as to cause harm to people in entirely different countries. If the drop is significant, I hope it is covered as a win for SEBI rather than a loss for the market. It is an out and out win in the long run.